Handling accounts payable can be a time-consuming task. Manual processes slow down efficiency.

But there’s a solution. Accounts payable automation software can streamline these tasks. It saves time, reduces errors, and boosts productivity. Today, many businesses are turning to automation. This shift helps them focus on growth rather than tedious paperwork. In this blog post, we will explore the best accounts payable automation software available.

These tools can transform your financial processes. They offer user-friendly features and impressive benefits. Ready to find out which software suits your needs? Let’s dive in and discover the top options for your business.

Introduction To Accounts Payable Automation

Discover the top accounts payable automation software that simplifies invoice processing. These tools streamline tasks, reduce errors, and save time. Ideal for businesses seeking efficiency and accuracy in financial operations.

Accounts payable automation transforms how businesses handle invoices and payments. This technology reduces manual tasks. It speeds up processes. It also helps avoid human errors. Many companies are now adopting this software. They find it saves time and money. But what exactly is accounts payable automation?What Is Accounts Payable Automation?

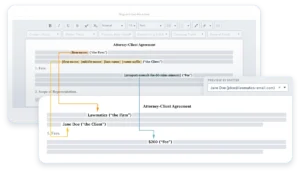

Accounts payable automation uses software to handle the payment process. It processes invoices electronically. The software matches invoices with purchase orders. It checks for errors and duplicates. It then approves the invoices for payment. This reduces the need for manual data entry. It makes the process faster and more accurate.Importance Of Automation In Finance

Automation in finance offers many benefits. It ensures accuracy in payments. This helps to avoid late fees and penalties. It also improves cash flow management. Automated systems provide real-time data. This helps in making informed decisions. It allows finance teams to focus on strategic tasks. They spend less time on repetitive work. This increases overall efficiency and productivity. “`

Credit: www.procurify.com

Key Features To Look For

Choosing the best accounts payable automation software can streamline your business processes. To help you make an informed decision, focus on key features. These features ensure the software meets your needs and enhances efficiency.

User-friendly Interface

A user-friendly interface is crucial. It allows users to navigate the software with ease. Intuitive designs reduce the learning curve. Employees can quickly adapt to the new system. This increases productivity and minimizes errors.

Integration Capabilities

Integration capabilities are essential. The software should work well with your existing systems. This includes accounting software, ERP systems, and other relevant tools. Seamless integration ensures data flows smoothly between systems. It reduces manual data entry and potential discrepancies.

Security Measures

Security measures are a top priority. The software must protect sensitive financial data. Look for features like data encryption, multi-factor authentication, and regular security updates. These measures safeguard your information from unauthorized access and cyber threats.

Top Software Solutions

Choosing the best accounts payable automation software can significantly streamline your business processes. Various platforms offer unique features to help manage invoices, payments, and vendor relationships. Let’s explore the top software solutions available in the market.

Overview Of Leading Platforms

Here, we will discuss some of the leading accounts payable automation software solutions. These platforms are known for their efficiency and user-friendly interfaces.

- Tipalti: Tipalti automates the entire accounts payable process, from invoice to payment. It supports global payments and ensures compliance.

- Bill.com: Bill.com simplifies the AP process with features like digital invoicing and automated workflows. It integrates well with major accounting software.

- AvidXchange: AvidXchange offers robust invoice and payment processing. It reduces manual data entry and speeds up the approval process.

- MineralTree: MineralTree provides a secure and efficient way to manage AP. Its features include fraud detection and seamless integration with ERP systems.

Comparison Of Features

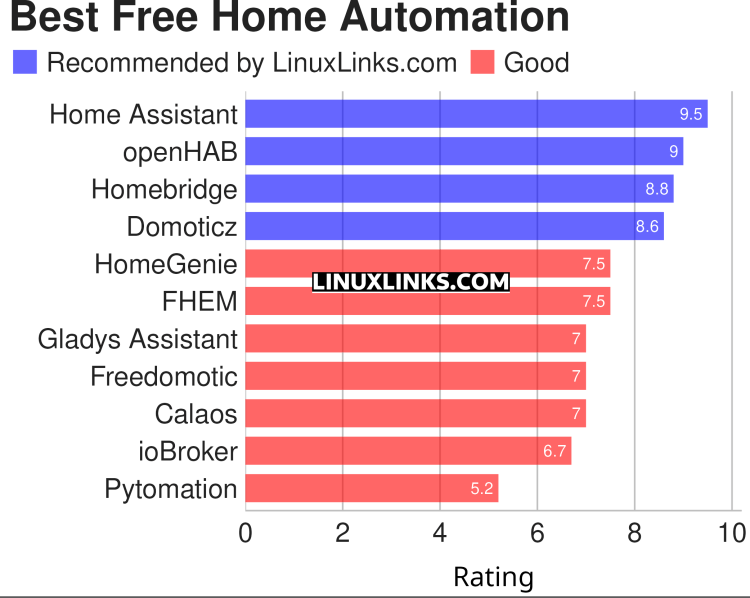

Below is a comparison of key features across these top platforms:

| Feature | Tipalti | Bill.com | AvidXchange | MineralTree |

|---|---|---|---|---|

| Global Payments | Yes | Yes | No | Yes |

| Invoice Automation | Yes | Yes | Yes | Yes |

| Approval Workflows | Yes | Yes | Yes | Yes |

| Fraud Detection | Yes | No | No | Yes |

| ERP Integration | Yes | Yes | Yes | Yes |

Each platform has unique strengths. Tipalti excels in global payments, while Bill.com offers strong integration capabilities. AvidXchange is known for speeding up the approval process, and MineralTree provides advanced security features.

Credit: www.appypie.com

Benefits Of Automation

Accounts payable automation software offers significant benefits for businesses. Automated systems streamline payment processes, saving time and reducing errors. This software also helps ensure compliance with financial regulations. Let’s explore these benefits further.

Time Savings

Automation speeds up invoice processing. It eliminates the need for manual data entry. Payments are processed faster, freeing up staff for other tasks. Businesses can focus on growth rather than paperwork.

Error Reduction

Manual data entry often leads to mistakes. Automation minimizes these errors by using accurate data capture. This ensures invoices are paid correctly. Fewer mistakes mean fewer disputes and better relationships with vendors.

Improved Compliance

Staying compliant with financial regulations is crucial. Automated software maintains accurate records. It ensures all transactions follow legal requirements. This reduces the risk of fines and penalties. Businesses can operate with peace of mind.

Cost Considerations

Choosing the best accounts payable automation software requires careful cost considerations. Understanding the pricing models and potential hidden costs can help you make an informed decision. Let’s explore these cost factors in detail.

Pricing Models

Accounts payable automation software often comes with various pricing models. Some companies offer subscription-based plans. Others may charge a one-time fee. Subscription plans typically include monthly or annual payments. These plans may vary based on features or user limits.

Another common pricing model is pay-per-use. This model charges based on the number of transactions processed. It’s ideal for businesses with fluctuating transaction volumes. Some vendors also offer tiered pricing. This model provides different feature sets at different price points. Choose a model that fits your budget and business needs.

Hidden Costs To Watch Out For

Be aware of hidden costs that can impact your budget. Implementation fees can add up quickly. Some vendors charge for setting up the software and initial training. These fees are often separate from subscription costs.

Maintenance and support fees are another consideration. Regular updates and technical support may come with extra charges. Some software providers charge for customizations. Tailoring the software to fit your specific needs may incur additional costs.

Lastly, consider the cost of integrating the software with existing systems. Integration fees can vary depending on the complexity. Make sure to ask about all potential costs before committing to a solution.

Credit: www.highradius.com

Implementation Tips

Implementing the best accounts payable automation software can streamline your financial processes. Proper implementation is crucial for success. Follow these practical tips to ensure a smooth transition.

Steps For Successful Integration

Integrating new software into your system involves a few vital steps. Here’s how to do it:

- Analyze Current Processes: Assess your existing accounts payable process. Identify areas that need improvement.

- Choose the Right Software: Select software that fits your business needs. Consider features, ease of use, and scalability.

- Plan the Integration: Create a detailed plan. Outline tasks, deadlines, and resources needed.

- Test the Software: Run tests to ensure compatibility with your current systems. Address any issues before full implementation.

- Monitor and Adjust: After implementation, monitor the software’s performance. Make adjustments as necessary.

Training Your Team

Training your team is essential for the successful use of new software. Here’s how you can do it effectively:

- Conduct Comprehensive Training Sessions: Organize sessions to familiarize your team with the software. Ensure everyone understands how to use it.

- Provide Resources: Offer user manuals, video tutorials, and other resources. These can help team members learn at their own pace.

- Encourage Hands-On Practice: Allow your team to practice using the software. Practical experience can build confidence and competence.

- Offer Ongoing Support: Be available to answer questions and solve problems. Continuous support can help maintain smooth operations.

Future Trends

As technology advances, the landscape of accounts payable automation software continues to evolve. Future trends promise to bring more efficient, secure, and intelligent solutions. These innovations will help companies streamline their financial processes. Let’s explore some key trends.

Ai And Machine Learning

AI and machine learning are shaping the future of accounts payable automation. These technologies can analyze vast amounts of data quickly. They identify patterns and anomalies that human eyes might miss. AI can predict future expenses based on historical data. This helps companies plan their budgets better.

Machine learning algorithms improve over time. They learn from past transactions and become more accurate. This reduces errors and speeds up the payment process. AI can also automate routine tasks. This frees up human employees to focus on more strategic activities.

Blockchain Technology

Blockchain technology offers new possibilities for accounts payable automation. It provides a secure and transparent way to record transactions. Each transaction is stored in a “block” and linked to the previous one, creating a “chain”. This makes tampering with records almost impossible.

Blockchain can enhance trust between trading partners. Both parties can access the same transaction data in real-time. This reduces disputes and speeds up the reconciliation process. Blockchain also supports smart contracts. These are self-executing contracts with the terms directly written into code. They ensure payments are made automatically when conditions are met.

The combination of AI, machine learning, and blockchain technology will transform accounts payable automation. Companies can expect more secure, efficient, and intelligent systems in the near future.

Frequently Asked Questions

What Is Accounts Payable Automation Software?

Accounts payable automation software streamlines the process of managing and paying invoices. It reduces manual tasks and errors. This software helps in tracking payments, improving efficiency, and saving time. It is essential for businesses to manage their finances effectively.

Why Use Accounts Payable Automation Software?

Using accounts payable automation software improves accuracy and efficiency. It reduces manual errors and saves time. The software helps in faster processing of invoices and payments. It also improves vendor relationships by ensuring timely payments.

How Does Accounts Payable Automation Work?

Accounts payable automation works by digitizing and automating invoice processing. Invoices are captured, verified, and matched with purchase orders. The software then routes invoices for approval and schedules payments. It reduces manual intervention and speeds up the process.

What Are The Benefits Of Accounts Payable Automation?

Accounts payable automation offers several benefits. It reduces manual errors, saves time, and improves efficiency. The software ensures timely payments, better tracking, and improved vendor relationships. It also provides better financial control and reporting.

Conclusion

Choosing the right accounts payable automation software is crucial. It streamlines your business processes. This software saves time and reduces errors. Efficient payment handling boosts productivity. Investing in automation improves overall financial health. Your team can focus on strategic tasks.

Evaluate your needs and choose wisely. The right tool can make a significant difference. Simplify tasks with accounts payable automation. Your business deserves the best.