Managing money can be hard without the right tools. Thankfully, budgeting apps can help.

In today’s digital age, keeping track of your finances has never been easier. With a wide array of budgeting apps available, you can now manage your money directly from your smartphone. These apps are designed to simplify your financial planning, track expenses, and help you save.

Whether you’re a student, a professional, or someone looking to get better at managing finances, there’s an app for you. Let’s explore the world of budgeting apps and find the perfect one to fit your needs. Discover how you can take control of your finances with the best budgeting apps available today.

Credit: www.cnn.com

Introduction To Budgeting Apps

Budgeting apps have become essential tools for managing personal finances. They help track spending, set savings goals, and create budgets. These apps provide a clear picture of where your money goes. Budgeting can be less stressful and more organized with these digital tools. Let’s explore why budgeting apps are worth using and their benefits.

Why Use Budgeting Apps

Many people struggle with managing their finances. Budgeting apps simplify this task. They automate tracking expenses and income. This saves time and reduces errors. You can access your financial data anytime, anywhere. This convenience makes it easier to stay on top of your finances.

Budgeting apps also offer insights and reports. These features help you understand your spending habits. You can identify areas where you overspend. This helps in making informed financial decisions. The apps also send reminders for bill payments. This prevents late fees and improves your credit score.

Benefits Of Digital Budgeting

Digital budgeting offers several advantages over traditional methods. First, it provides real-time updates. You always know your current financial status. Second, it eliminates the need for manual calculations. This reduces the chance of errors. Third, it helps in setting and achieving financial goals. You can track your progress and stay motivated.

Another benefit is the ability to categorize expenses. This helps in understanding spending patterns. You can easily see where most of your money goes. The apps also provide tips and suggestions. These can help you save money and improve your financial health. Lastly, digital budgeting promotes better financial habits. It encourages regular tracking and planning.

Credit: goodbudget.com

Features To Look For

Choosing the best budgeting app can be a daunting task. There are many options available. To make the right choice, focus on the features that matter most. Below are some key features to consider.

User-friendly Interface

A user-friendly interface is crucial. It makes the app easy to navigate. Look for clear menus and intuitive design. Avoid apps that seem cluttered or confusing. A clean layout helps you manage your budget without stress.

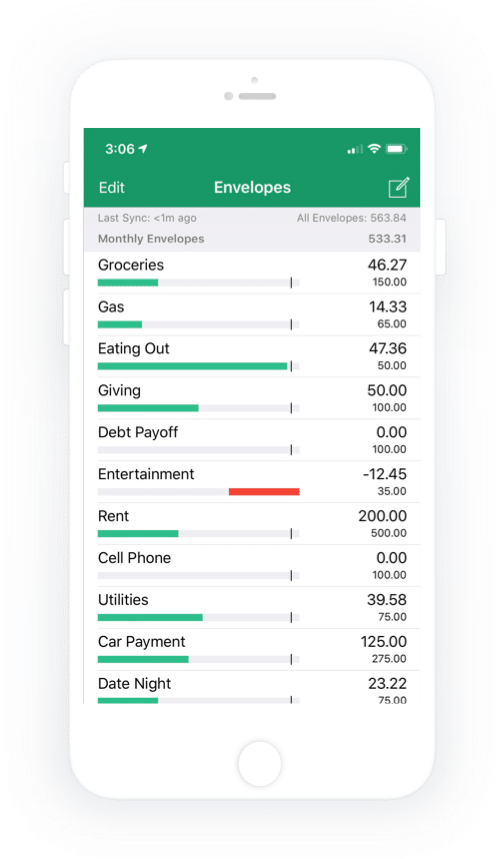

Customizable Categories

Customizable categories allow you to tailor the app to your needs. Standard categories include groceries, rent, and utilities. But you may want to add personal categories like “pet care” or “travel.” This feature helps you track spending more accurately.

| Feature | Benefit |

|---|---|

| User-Friendly Interface | Makes navigation easy |

| Customizable Categories | Tailors the app to your needs |

These features enhance your budgeting experience. They simplify the process and make it enjoyable.

Top Free Budgeting Apps

Managing money can be challenging, but budgeting apps can help. These apps are user-friendly and free. They offer essential features for effective budgeting. Here are some top free budgeting apps you can consider.

App Highlights

Each budgeting app has unique features. They help track spending, manage bills, and create budgets. Some apps offer syncing with bank accounts. Others provide alerts for due bills. These features make budgeting easier and more efficient.

Pros And Cons

Free budgeting apps have several advantages. They are cost-effective and easy to use. They provide essential budgeting tools. However, they may have limited features compared to paid versions. Some apps may also display ads. Choose an app that best suits your needs.

Best Paid Budgeting Apps

Finding the right budgeting app can transform your financial life. While there are many free options available, sometimes paying a bit more can make a huge difference. Here are the best paid budgeting apps that offer unique features and great value for money.

Unique Features

Paid budgeting apps often come with features that free versions lack. These features can help you manage your finances more effectively.

- Customizable Categories: Create your own spending categories to track your expenses.

- Bill Tracking: Set up reminders for upcoming bills to avoid late fees.

- Investment Tracking: Keep an eye on your investment portfolio’s performance.

- Shared Accounts: Manage finances with a partner or family member.

- Advanced Reporting: Generate detailed financial reports to understand your spending habits.

Value For Money

Paid budgeting apps offer great value by providing advanced features and superior customer support. Here is a comparison of some top paid budgeting apps:

| App | Price | Key Features |

|---|---|---|

| YNAB (You Need A Budget) | $11.99/month | Goal setting, Debt payoff planner, Real-time sync |

| Goodbudget | $7/month | Envelope budgeting, Income tracking, Expense tracking |

| EveryDollar | $9.99/month | Bill reminders, Savings goals, Dave Ramsey integration |

These apps offer a range of features that can justify the cost. Investing in a paid budgeting app can save you money in the long run by helping you manage your finances better.

Budgeting Apps For Couples

Managing finances as a couple can be challenging. Coordinating expenses, sharing accounts, and tracking joint spending requires effective tools. Budgeting apps for couples simplify these tasks. They help in organizing shared finances seamlessly. Let’s explore how these apps can benefit you.

Shared Accounts

One key feature of budgeting apps for couples is shared accounts. Shared accounts allow both partners to view and manage finances together. This promotes transparency. It ensures both partners are on the same page financially. Shared accounts help in setting joint financial goals. They make it easier to track income and expenses.

Joint Expense Tracking

Another essential feature is joint expense tracking. Joint expense tracking helps couples monitor their spending habits. This feature categorizes expenses automatically. It provides insights into where the money goes. Couples can easily identify areas where they can save. Joint expense tracking helps in avoiding overspending.

Credit: www.youtube.com

Budgeting Apps For Families

Managing family finances can be challenging. Budgeting apps can simplify the process. These apps help families track expenses, save money, and plan for the future. With user-friendly features, they make budgeting easy for everyone.

Family-friendly Features

Family budgeting apps offer unique features. They cater to the needs of families. For instance, they have easy-to-use interfaces. This ensures that even children can understand them. Some apps also include educational tools. These tools teach kids about saving and spending.

Another important feature is goal setting. Families can set financial goals together. This fosters teamwork and accountability. The apps send reminders to keep everyone on track. It helps ensure that the family meets its financial targets.

Managing Multiple Users

Family budgeting apps often support multiple users. Each family member can have their own account. This allows everyone to participate. Parents can monitor spending without micromanaging. Children learn to manage their own money.

These apps also include sharing features. Family members can share receipts and expenses. This keeps everyone informed. Transparency is key. Everyone knows where the money is going. It helps avoid misunderstandings and promotes trust.

Frequently Asked Questions

What Is The Best Free Budgeting App?

The best free budgeting app varies by need. Popular options include Mint and YNAB. They offer robust features, user-friendly interfaces, and comprehensive financial insights.

How Do Budgeting Apps Work?

Budgeting apps connect to your bank accounts. They track your spending, categorize expenses, and help you set budgeting goals. They provide real-time financial insights.

Are Budgeting Apps Safe To Use?

Yes, most budgeting apps are safe. They use bank-level encryption and secure connections. Always choose reputable apps and read their security policies.

Can Budgeting Apps Help Save Money?

Yes, budgeting apps help save money. They provide spending insights, identify savings opportunities, and help you set financial goals. They promote mindful spending.

Conclusion

Budgeting apps can transform how you manage your finances. They make tracking expenses and saving money easier. Choose one that fits your needs and preferences. Explore different features and benefits. Start taking control of your financial future today. Remember, small steps lead to big changes.

Happy budgeting!